Non-US Citizen Receives Social Security - Is It Taxable? Explained in Plain English.

U.S. Social Security Payments to non-resident

U.S. Social Security benefits may be paid to non-resident aliens. Those payments may be for work previously performed in the US or spousal benefits.

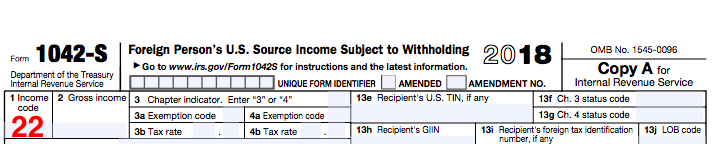

Generally Social Security benefits paid to non-resident alien are reported on form 1042-S with income code 22. The applicable federal tax amount will be withheld at source. The benefit recipient will receive payment net of tax withholding

WIthholding Rates & US Income tax filing

Default tax withholding rate on benefits paid to non-US persons is 30%. The withholding is applied on 85% of payment. Thus, if annual benefit, is $10,000 then 30% tax will be withheld from $8,500 --- totalling $2,550.

If this is the only US-sourced income then the non-resident alien receiving payments does not need to file a U.S. tax return. This tax will not be refunded, and the required tax amount is being withheld at source.

Certain countries outlined in the table below have special treaty benefits where U.S. Social Security benefits have reduced, sometimes to 0, withholding rates.

|

Canada |

Egypt |

Germany |

Ireland |

|

Israel |

Italy |

Japan |

Romania |

|

Switzerland |

UK |

|

|

I live in one of these countries - how do I get my money back?

To qualify for the treaty tax exemption the beneficiary must file form W-8-BEN and present it to the U.S. Social Security Administration.

- Note - if the form is not timely filed, or the treaty article is quoted incorrectly, then the payment may have excessive withholding.

After filing Form W-8-BEN, the non-resident alien can file form 1040NR to request the refund. Future withholding should be reduced once the W-8-BEN is on file. Note - 1040NR is required to receive prior withholding; the Social Security administration cannot process the refund but it will accept the new form W-8BEN to reduce future withholding.