US tax preparation for Americans in Singapore

Real people, just like you.

50,000+ clients, 193+ countries, 4,000+ reviews

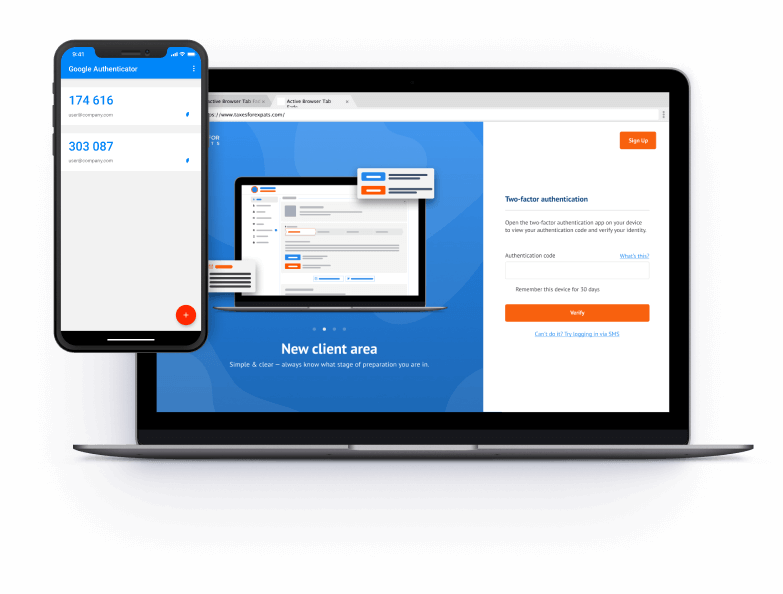

Data secured by

two-factor authentication

How TFX can help

Expert team, no junior staff

At TFX, we have been preparing business tax returns for over 25 years. We never hire junior staff. No outsourcing, no middlemen: you’ll be working directly with an experienced (our average age is 42) CPA or EA who will handle your case from beginning to end.

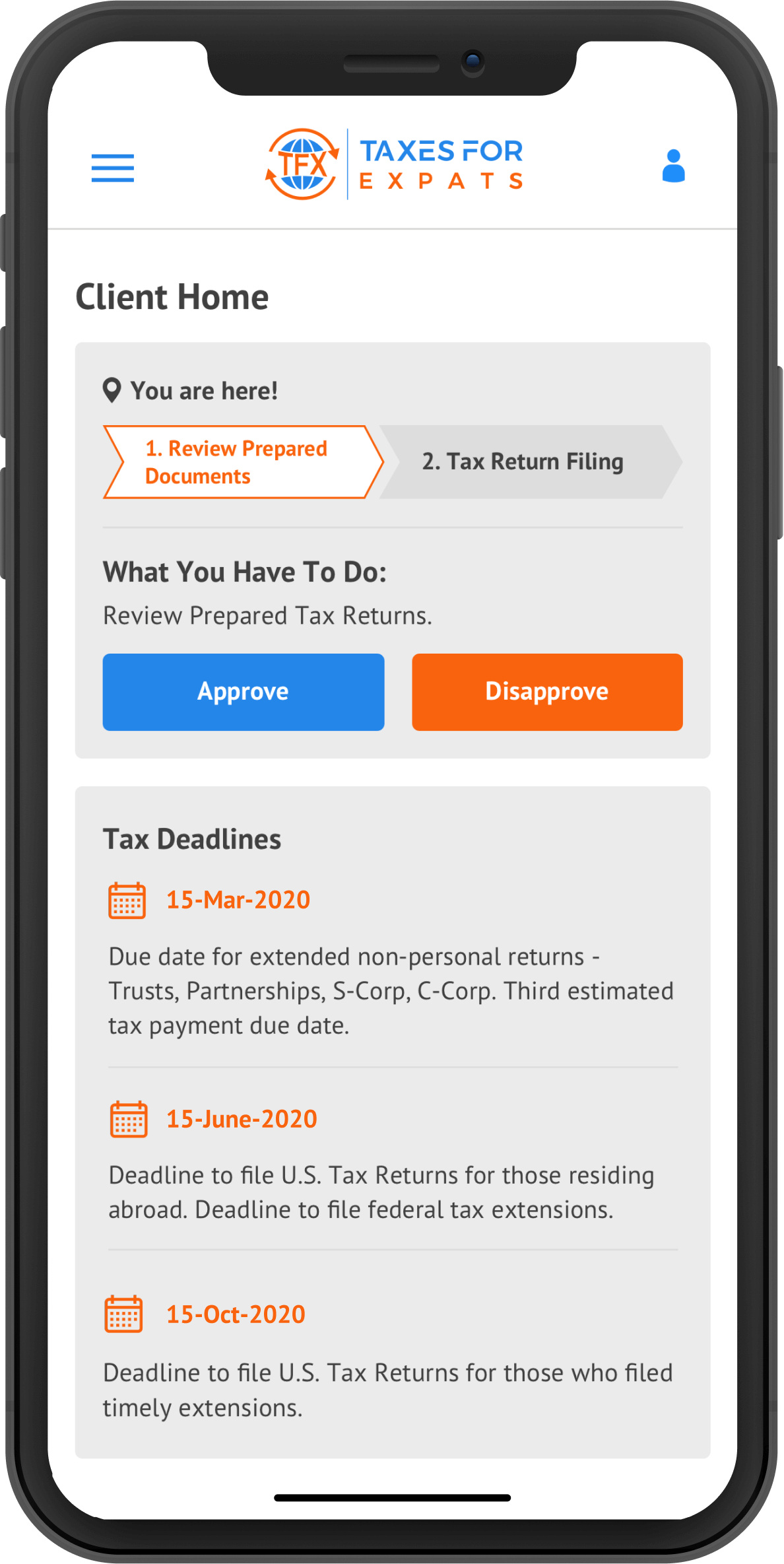

Help & support

Aside from knowledge, convenience and security are what we value at TFX. And these key features are what our clients are thrilled with. Our best-in-class secure online portal makes TFX the top-rated tax firm (with an average score of 4.8/5 on Trustpilot).

Phone consultations

In addition to tax filing & compliance, TFX offers tax planning & phone consultations. Choose a convenient time & book directly in your client portal.

Transparent pricing

TFX pricing is transparent, which means you’ll always know what you pay for.

We make it easy for you

-

Create

an account -

Complete

Tax questionnaire -

Sign

Engagement letter -

Sit back

while we work -

Pay

and review

Articles & tax guides

View all →Zu verstehen, wie das Steuersystem der USA funktioniert, ist für amerikanische Bürger und Green Card-Inhaber gleichermaßen wichtig - ganz gleich, wo auf der Welt sie leben. In den USA gibt es spezielle Verfahren für die Steuererklärung, Steuersätze und Verpflichtungen für in den...

Behind on US tax returns or missed FBARs while living abroad? The IRS Streamlined Filing Compliance Procedures may let you catch up with reduced or no penalties – as long as your failure to file was non-willful. Under the ...

2026 filing season update: Filing your 2025 tax return? Form 8938 requirements remain unchanged for the 2025 tax year. If your specified foreign financial assets exceeded the applicable thresholds at any point in 2...

If you're a taxpayer, you may have wondered about your chances of being audited by the IRS. While the audit rate for individual taxpayers has generally been declining in recent years, it's still important to understand the factors that can increase your risk and take steps to reduce them. In this article, we'll pro...

Default Citizenship by Birth Thanks to the US Constitution’s Fourteenth Amendment, any person born in the United States is automatically a US Citizen ...

Whether you live in the US or abroad, if you hold an account in a foreign bank — whether savings, pension, or investment — you may be required to comply with FBAR (Report of Foreign Bank and Financial Accounts) filing requirements. Many Americans are unaware that simply having a foreign bank account can trigger FBAR obligations. ...