Streamlined Procedure: Which Years to File?

Which years to file?

If you are behind on your tax returns & want to become compliant, the first question you likely have is - what years do I need to file?

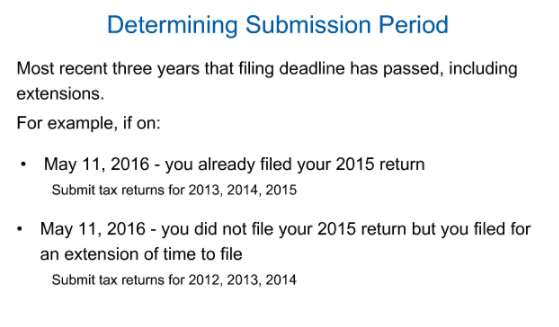

The Streamlined Program is an olive branch from the IRS, offering delinquent taxpayers the ability to get caught up with amnesty from draconian failure to file penalties and FBAR penalties. The program is very procedural and requires you to file 3 years of tax returns and 6 years of FBARs. Which years are they referring to? Let’s dive in.

The program stipulates that you must file the 3 most recent delinquent tax returns, including extensions. At the time of updating this article (May 2025), those years are 2022, 2023 and 2024.

|

Why not 2023, 2024 and 2025? |

The IRS has provided a wealth of resources, including the following to help determine what you should file.

*Source - IRS

What should you do now?

If you are behind on your tax returns, you should take the necessary steps and get complaint ASAP by filing 2022–2024 streamlined procedure. We recommend waiting 45 days after mailing your (2022–2024) SP package to file the next year (2025) return.

Pros of doing 2022–2024

- Less tax fees for you since you do not have to do 2023 separately.

Cons of waiting until 2025 is overdue and filing 2022–2024 SP

- Outside of direct IRS guidance.

- RIsk that the IRS changes the program. More time passes that you are not in compliance — risk that IRS may contact you (if you are under civil examination you may not be eligible for the program).

Strike while the iron is hot!

The current program is extremely lenient and offers amnesty; outside of the IRS commissioner, no one can handicap the risk of the program changing, but one can assume it is not permanent. Once enough taxpayers find out about it (the program has been in existence in its current form since 2014) the IRS can take away the parachute - we would not assume that it is permanent.

OVDP Program Discontinued!

On Tuesday, March 13th, 2018 the IRS announced the OVDP program will be closed on Sep 28, 2018. The streamlined program will remain untouched for now, but this news can be taken as the canary in the coal mine that these programs are not going to be around forever, and it is in the best interest of the non-compliant taxpayer to take advantage of them while they are around and offer amnesty.

Streamlined Offshore Procedure Explained Webinar

Check out our webinar on Streamlined Procedure with TFX CPA and read the article based on the live Q&A we've hosted.