(update) IRS Requires New ID.me Facial Recognition System

updated - Mar 3, 2023

The IRS has finally shifted its online services for tax professionals to a third-party authentication software company called ID.me. As a result, accountants will need to create an ID.me account to access the IRS website.

An ID.me Account Now is a Must

The integration between ID.me and the IRS means that individuals will be using ID.me credentials to log in to the IRS website, and ID.me is simply facilitating this process.

The transition to ID.me has impacted various products and applications, including:

- Affordable Care Act,

- e-File Application,

- Information Returns,

- Income Verification Express Service, and more.

The IRS required the adoption of ID.me for e-Services applications on June 15, 2022. Legacy secure access credentials will no longer be valid for accessing e-Services applications since this date. Moreover, all users will need to use multi-factor authentication (MFA) to log in.

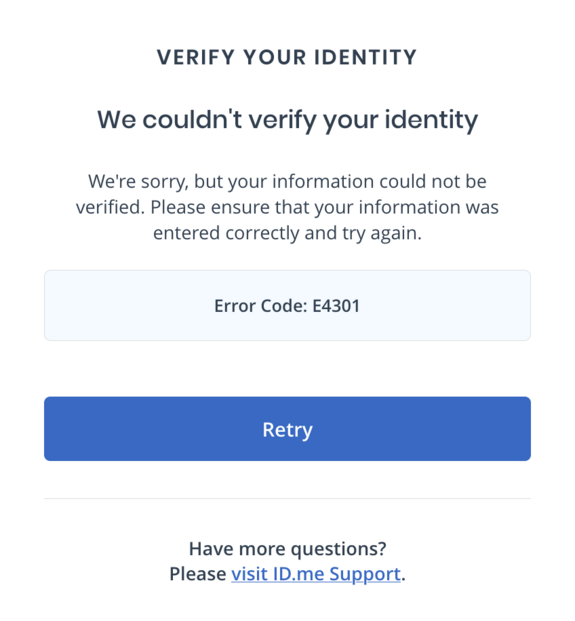

No More Facial Recognition Software

ID.me previously used facial recognition software to verify users' identities, but users can now opt out of this step due to privacy concerns. Users can still use the software for verification, but it is no longer mandatory. Users can choose to video chat with a "trusted referee" instead of using facial recognition software. Once the verification is complete, ID.me deletes the biometric information collected from users.

To set up an ID.me account, users need to navigate to the IRS website and go to the "sign into your account" page. If they already have an ID.me account, they can select "Sign in with ID.me." If they do not have an account, they can select the option to create one.

They need to enter their email and choose a secure password. Then, they can choose to verify their identity using biometric authentication or video chat with an agent, depending on their preference.

Also Benefits - Overcoming the Pandemic-Induced Backlog

The IRS has faced significant challenges due to the COVID-19 pandemic and has responded with both short-term and long-term solutions to address the resulting backlog. In August 2020, the CAF units added temporary staffing to process more authorizations; however, most of these employees have since returned to other business units. To address long-term staffing needs, the CAF units are currently in the process of hiring more than 100 employees across their three locations.

To further streamline the authorization process, the IRS has introduced two new tools in 2021. The first is an online portal that allows taxpayers and tax professionals to submit a signed authorization electronically. The second is Tax Pro Account, which permits tax professionals to request an authorization from an individual taxpayer's online IRS account for electronic signature. While it is still possible to submit an authorization request via mail or fax, processing times are expected to be longer.

Submissions through the online portal are processed in the same manner as mail and fax submissions, while submissions through the Tax Pro account undergo verification to ensure that the tax professional is in good standing and are recorded to the CAF within 48 hours of the taxpayer's acknowledgement. Although these new tools are a welcome addition, they are currently underutilized and present some challenges.

(original) ID.me accounts now required to access online accounts for US taxpayers

In a push for increased security, the IRS has unveiled a new verification process for US taxpayers who want to access their online accounts. The IRS will be utilizing the third party service, ID.me to verify individuals. Verification will include taking a selfie and submitting a photo of driver’s license or passport.

IRS portals that require ID.me

This verification is needed to access data - but not to pay taxes. The other online IRS portals that will require using ID.me verification are: your IRS online account, obtaining a transcript online, Child Tax Credit Update Portal, Get an Identity Protection PIN (IP PIN) and Online Payment Agreement.

You can still pay taxes without utilizing ID.me.

How to get verified

Getting verified is a multi-step process.

- Create id.me account

- Upload a photo of your license or state ID, passport, or social security card.

- Take a video selfie (you will receive a text message with a secure link)

- Enter social security number

- If you are unable to verify your identity through the automated system, video call possible

Anecdotal evidence: Getting verified is difficult

There are reports that women and people of color are having more difficulty being verified through the software than others.

Items of note, especially for expats

- Address on your account must match the verification documents

- Documents in a foreign language may be rejected.

- If you are unable to verify online, you will have to show physical documents to the online agent.

ID.me history

ID.me is a private company with government contracts with many state agencies and now the IRS to verify legal identities of individuals.