US tax preparation for Americans in Belgium

Real people, just like you.

50,000+ clients, 193+ countries, 4,000+ reviews

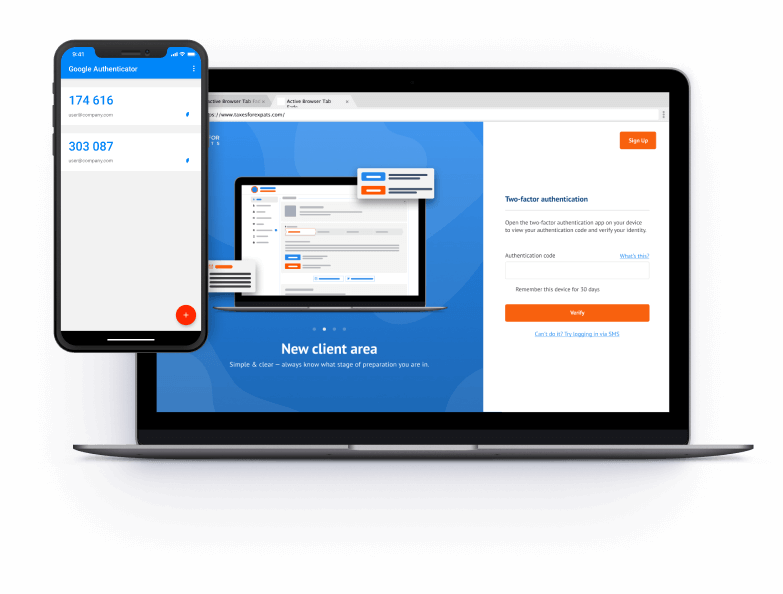

Data secured by

two-factor authentication

How TFX can help

Expert team, no junior staff

At TFX, we have been preparing business tax returns for over 25 years. We never hire junior staff. No outsourcing, no middlemen: you’ll be working directly with an experienced (our average age is 42) CPA or EA who will handle your case from beginning to end.

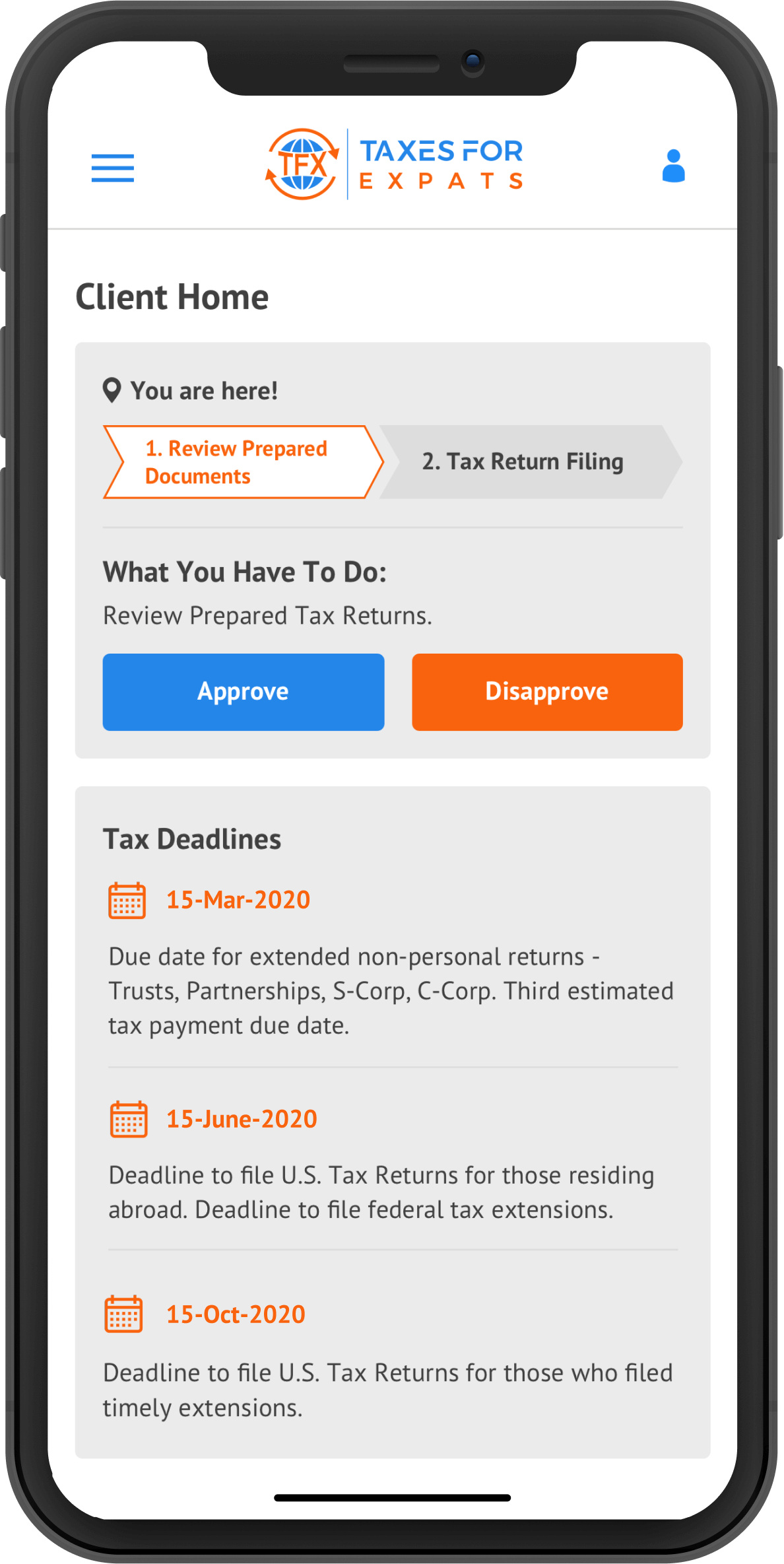

Help & support

Aside from knowledge, convenience and security are what we value at TFX. And these key features are what our clients are thrilled with. Our best-in-class secure online portal makes TFX the top-rated tax firm (with an average score of 4.8/5 on Trustpilot).

Phone consultations

In addition to tax filing & compliance, TFX offers tax planning & phone consultations. Choose a convenient time & book directly in your client portal.

Transparent pricing

TFX pricing is transparent, which means you’ll always know what you pay for.

We make it easy for you

-

Create

an account -

Complete

Tax questionnaire -

Sign

Engagement letter -

Sit back

while we work -

Pay

and review

Articles & tax guides

View all →The taxation of foreign dividends can be complex for US taxpayers, especially expats who invest globally. Tax obligations and withholding requirements vary, but proper reporting helps you avoid double taxation and stay compliant. What you'll learn: How qualified vs. ordinary dividends affect your t...

The penalty for failing to report your foreign bank accounts in 2026 could cost more than the accounts themselves, with willful FBAR penalties reaching $165,353 or 50% of the account balance per violation. FinCEN’s latest inflation adjustment and tighter enforcement, along with new court rulings, have made F...

The United States does not impose federal income tax on foreign inheritance received by US citizens or residents. In simple terms, money or property received from abroad is usually not taxed when it comes in. However, foreign inheritances over $100,000 must be reported to the IRS using Form 3520, and any income earned from inherited assets is tax...

The foreign tax credit carryover allows US taxpayers to apply unused foreign tax credits to offset future US tax liability. Excess credits can be carried forward 10 years or back 1 year. This prevents loss of valuable tax benefits when foreign taxe...

Yes, minors typically get taxes taken out of their paycheck just like adults if they earn more than the standard deduction. For 2026, minors must file taxes if they earn more than $16,100 in wages. However, many teens can claim exempt status on Form W-4 if they expect to owe no federal tax, preventing withholding. Minors can get refunds by filing...

Millions of Americans pack up and start over abroad every year – the State Department estimates about 9 million US citizens live outside the country. Many US citizens living overseas don’t realize the IRS can still expect a Form 1040, even when income is earned far from the US and daily life feels settled elsewhere. When pri...