Expat tax services from trusted tax experts

Why us

Long-term relationship

Our processes and systems are built around you, the client. More than 90% of clients return year after year and we have an industry-high 70 NPS.

Tailored service, timely responses

We bring years of experience to handle your unique tax needs. We prioritize timely responses and clear communication.

Dual expert review

Our team consists of experienced CPAs who manage your filings with accuracy and efficiency.

Trusted by 50,000+ clients

Mentioned in

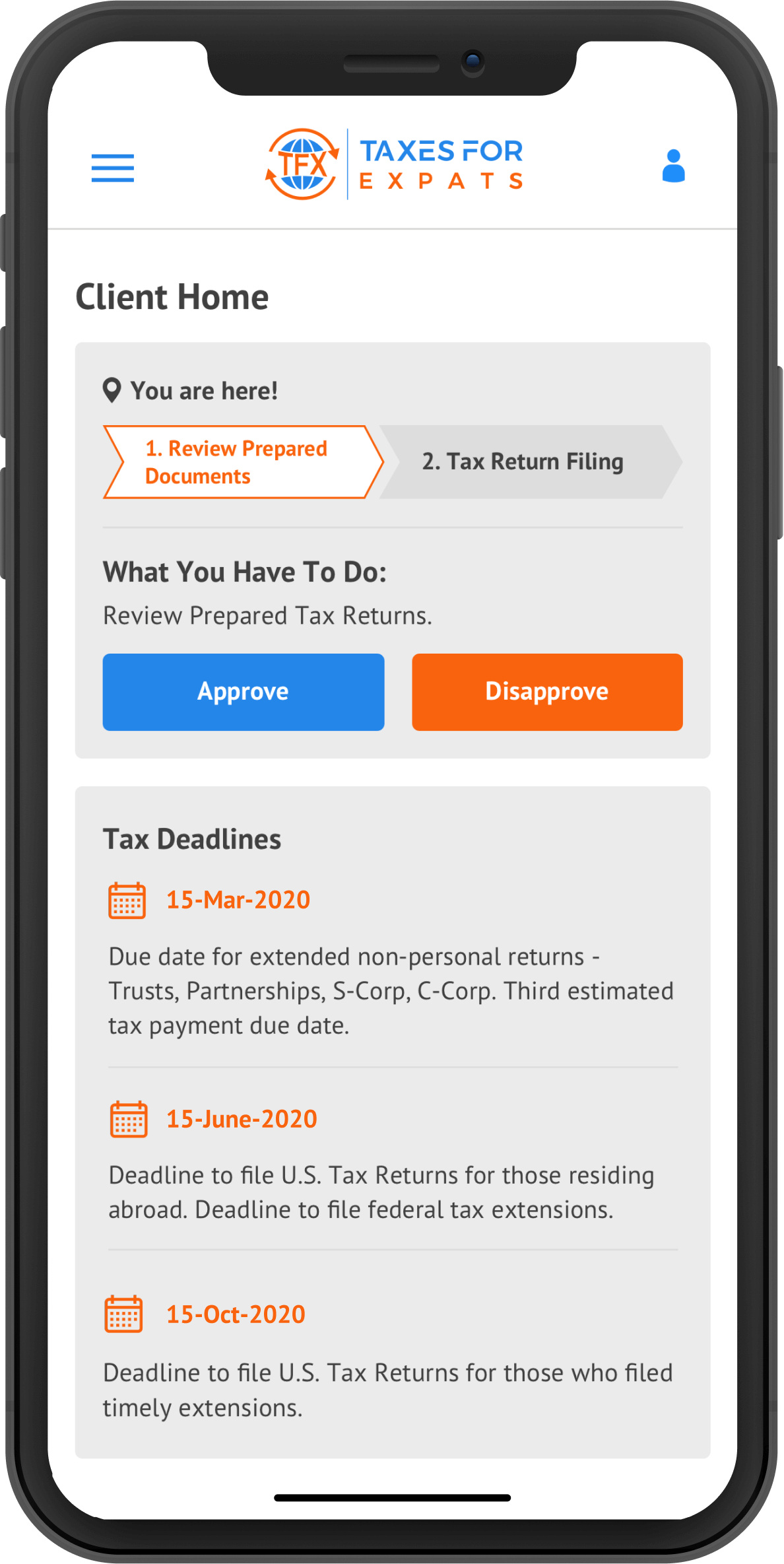

We make it easy for you

-

Create

an account -

Complete

Tax questionnaire -

Sign

Engagement letter -

Sit back

while we work -

Pay

and review

Expert, human accountant working on your case

Professionals who care & stand ready to answer your questions. Experienced humans who understand expat taxation in and out.

80+ accredited CPAs, EAs, JDs.

Real people, just like you.

50,000+ clients, 193+ countries, 4,000+ reviews

Articles & tax guides

View all →If you’re a US citizen or resident who owns, benefits from, or contributes to a foreign trust – such as a foreign pension plan, or a family estate trust set up abroad – you’re likely dealing with a complex set of reporting obligations. Whether you’re planning to set up a trust or already receiving distribu...

The US remittance tax is a 1% federal excise tax on certain money transfers sent from the United States to foreign countries, effective January 1, 2026. The tax applies only to cash-funded transfers, including cash, money orders, and cashier's checks. Bank account transfers and US debit/credit card payments are exempt under IRC Section 4475.<...

The penalty for failing to report your foreign bank accounts in 2026 could cost more than the accounts themselves. Willful FBAR violation penalties reach up to the greater of $165,353 or 50% of the account balance. FinCEN's latest inflation adjustment and tighter enforcement, along with new court rulings, have made FBAR compliance r...

If you're earning income in the US but aren't a tax resident, you'll need to deal with Form 1040-NR. The form can feel like a maze of regulations and unfamiliar terms, but understanding it is necessary for staying compliant. This guide breaks down how Form 1040-NR works, so you can handle your tax obligations accurately and ...

Having covered the full mechanics of the Trump Account, its comparison with 529, what to do when your child turns 18, down to the exit strategies in case you are no longer interested, article 8 in our ...

This article compares Trump Accounts to the traditional ways families have saved for children: regular savings accounts, UGMA/UTMA custodial accounts, and trusts. The question every parent asks I can already open a savings account in my child's name at any bank. I can set up a custodial account. I can create a trust.&nbs...

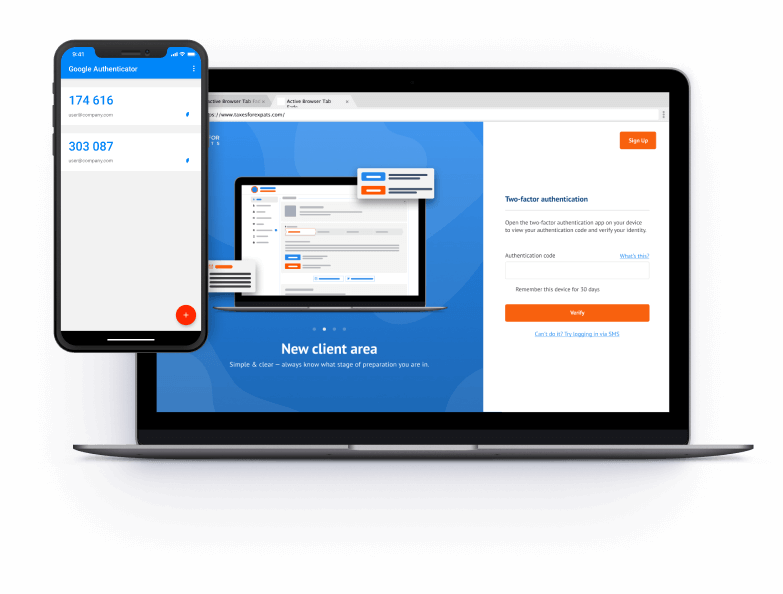

Data secured by

two-factor authentication