Real people, just like you.

50,000+ clients, 193+ countries, 4,000+ reviews

Expert, human accountant working on your case

Professionals who care & stand ready to answer your questions. Experienced humans who understand expat taxation in and out.

80+ accredited CPAs, EAs, JDs.

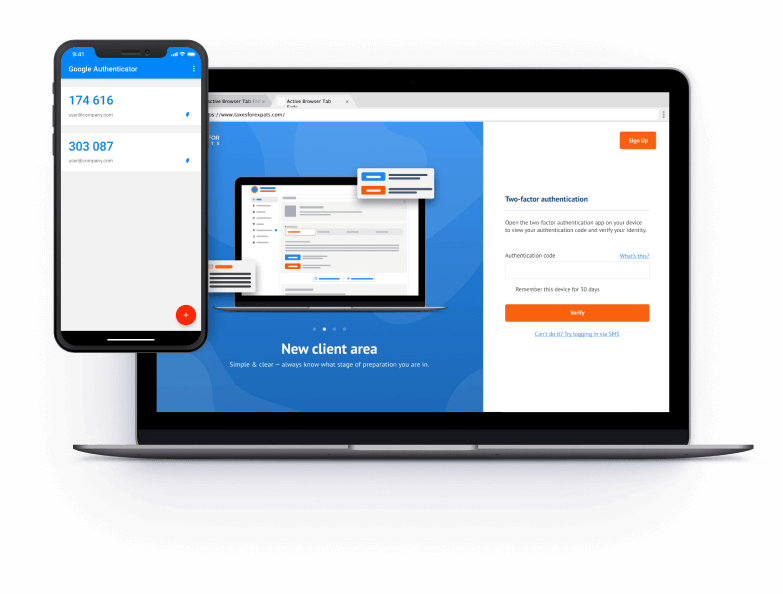

Data secured by

two-factor authentication

Articles & tax guides

Updated RMD guidelines effective from 2025: What you need to know

The IRS has released updated guidance on Required Minimum Distributions (RMDs) for certain retirement accounts, with changes set to take effect in 2025. This new guidance clari...

Updated IRS guidelines for inherited retirement accounts

The IRS has announced an extension through 2024 for the enforcement of required minimum distributions (RMDs) from certain inherited retirement accounts. This decision allows heirs additional time to strategically plan their withdrawals, following changes made by legislation in 2019. Detailed implications for ...

Understanding tax extensions and payment obligations 2024

As tax season approaches, it's crucial for taxpayers to understand the implications of filing for an extension. While an extension provides additional time to file your tax returns, it does not grant extra time to pay any taxes owed. Here's a structured breakdown to help you navigate this important distinction: ...

A comprehensive guide to IRS Form 56 for expats

Disclaimer This article is for informational purposes only and does not constitute legal or tax advice. Always consult with a tax professional for your specific circumstances. ...

IRS reminder to taxpayers affected by terrorist attacks in Israel: reliefs available

The IRS is reminding taxpayers affected by the terrorist attacks in Israel that the deadline for filing their 2023 federal income tax returns and making payments has been extended to October 7, 2024. This extension applies to individuals who live in the United States and were either injured in the attacks or are the survivors of individ...

IRS offers tax relief for Maine and Rhode Island taxpayers affected by severe storms and flooding

The IRS has announced tax relief for taxpayers in Maine and Rhode Island who were affected by severe storms and flooding. The relief includes extending various tax deadlines to July 15, 2024. Also read – ...

We make it easy for you

-

Create

an account -

Complete

Tax questionnaire -

Sign

Engagement letter -

Sit back

while we work -

Pay

and review