US tax preparation for Americans in Ireland

Real people, just like you.

50,000+ clients, 193+ countries, 4,000+ reviews

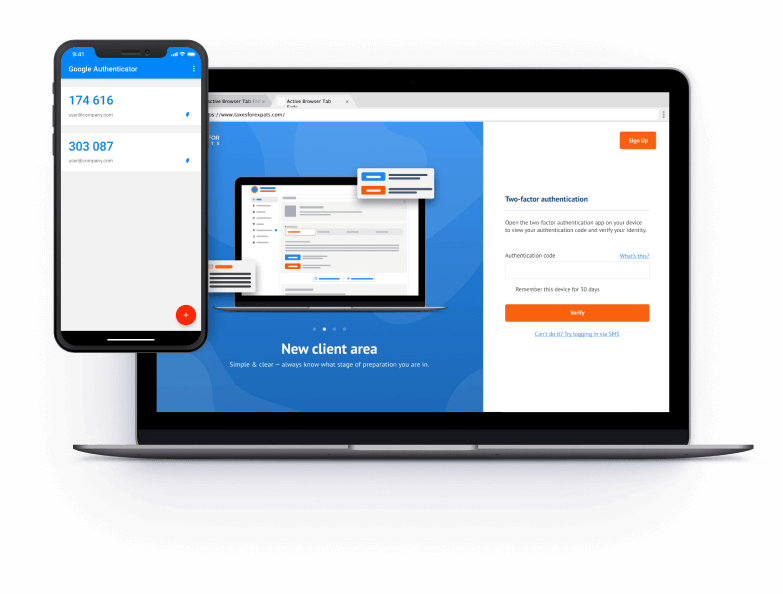

Data secured by

two-factor authentication

How TFX can help

Expert team, no junior staff

At TFX, we have been preparing business tax returns for over 25 years. We never hire junior staff. No outsourcing, no middlemen: you’ll be working directly with an experienced (our average age is 42) CPA or EA who will handle your case from beginning to end.

Help & support

Aside from knowledge, convenience and security are what we value at TFX. And these key features are what our clients are thrilled with. Our best-in-class secure online portal makes TFX the top-rated tax firm (with an average score of 4.8/5 on Trustpilot).

Phone consultations

In addition to tax filing & compliance, TFX offers tax planning & phone consultations. Choose a convenient time & book directly in your client portal.

Transparent pricing

TFX pricing is transparent, which means you’ll always know what you pay for.

We make it easy for you

-

Create

an account -

Complete

Tax questionnaire -

Sign

Engagement letter -

Sit back

while we work -

Pay

and review

Articles & tax guides

View all →For Americans living overseas, IRS Form 14653 is the key step in the Streamlined Filing Procedures that allow you to return to compliance without harsh penalties. The form includes a short narrative statement explaining why past filing gaps were non-willful, making it central to a successful submission. To avoid future problems, follow our...

If you’ve been living outside the United States for years, it might seem natural to assume your US tax obligations ended with your last paycheck on American soil. But they didn’t. The United States taxes its citizens and green card holders on their worldwide income, and in most cases, you’re required to file a return once your i...

The Internal Revenue Service (IRS) introduced the Streamlined Foreign Offshore Procedures to give Americans abroad a fair way to catch up on missed tax filings without facing crushing fines. Instead of penalties, eligible taxpayers can come forward, submit the required filings, and settle only the tax and interest due. This guide walks ...

If you receive a large gift or inheritance from someone abroad, you might wonder if you owe tax. In most cases, you don’t – but you may need to report it to the IRS using Form 3520. This guide explains what the foreign gift tax really means, when you must report, how the rules work in 2025, and what recent laws like the One Big Beauti...

Owning a foreign company means your US tax responsibilities don’t end at the border. Even if you live overseas, the IRS still requires you to report foreign business interests and financial accounts, often through complex information returns and the FBAR. Below, we break down what you need to file, when it’s due, what penalties to avo...

Foreign pension income isn’t something you can afford to ignore come tax season. If you're a US citizen or resident, the answer to Is foreign pension income taxable in the US? is a firm yes – regardless of where the money originates or where you currently live. From employer plans in Europe to private retirement accounts in Asia, ...