US tax preparation for Americans in UAE

Real people, just like you.

50,000+ clients, 193+ countries, 4,000+ reviews

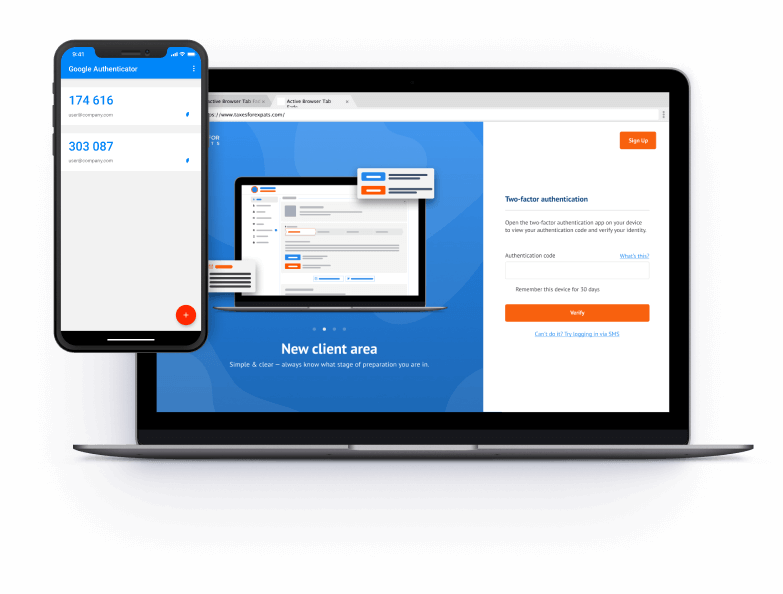

Data secured by

two-factor authentication

How TFX can help

Expert team, no junior staff

At TFX, we have been preparing business tax returns for over 25 years. We never hire junior staff. No outsourcing, no middlemen: you’ll be working directly with an experienced (our average age is 42) CPA or EA who will handle your case from beginning to end.

Help & support

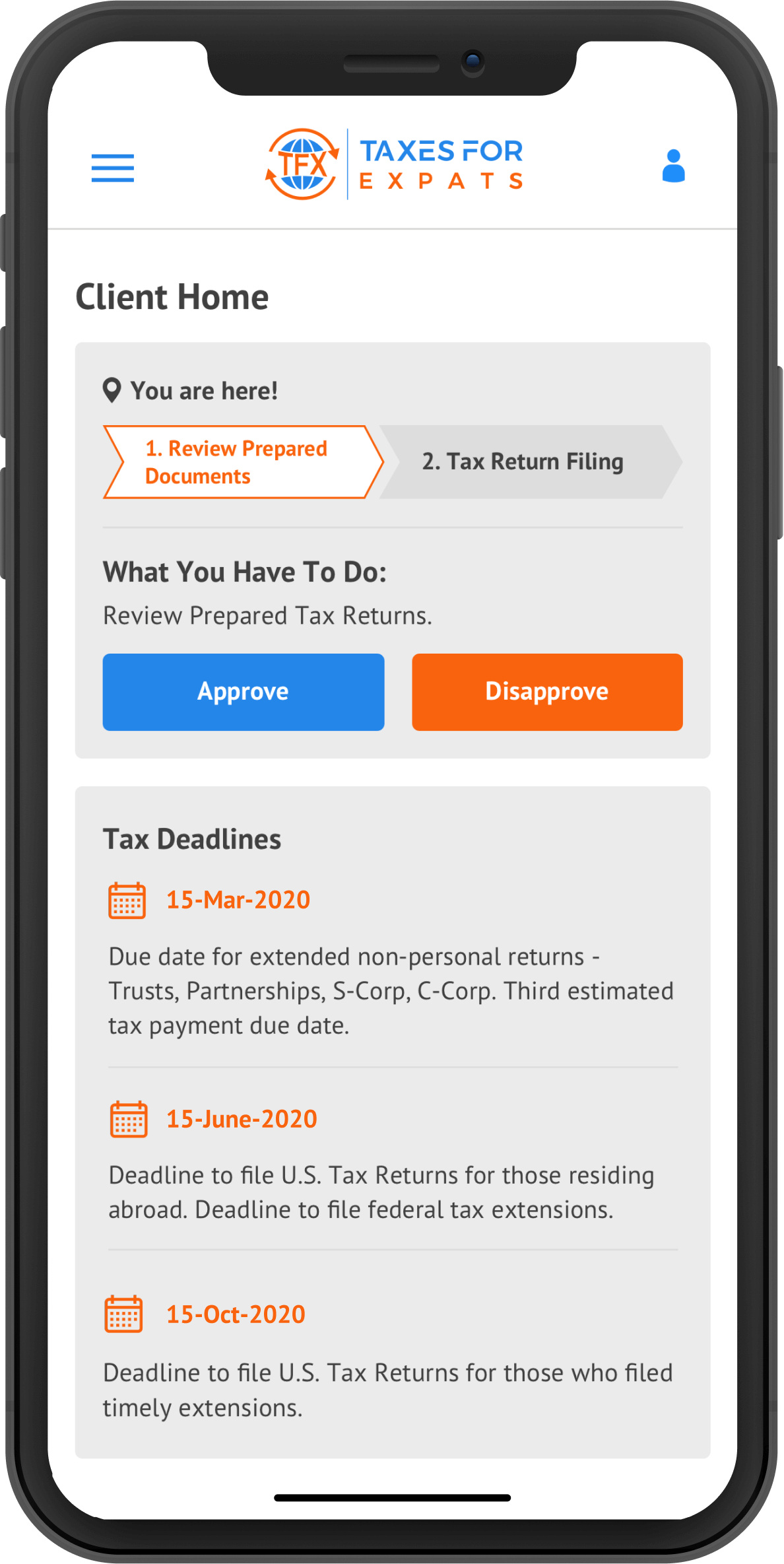

Aside from knowledge, convenience and security are what we value at TFX. And these key features are what our clients are thrilled with. Our best-in-class secure online portal makes TFX the top-rated tax firm (with an average score of 4.8/5 on Trustpilot).

Phone consultations

In addition to tax filing & compliance, TFX offers tax planning & phone consultations. Choose a convenient time & book directly in your client portal.

Transparent pricing

TFX pricing is transparent, which means you’ll always know what you pay for.

We make it easy for you

-

Create

an account -

Complete

Tax questionnaire -

Sign

Engagement letter -

Sit back

while we work -

Pay

and review

Articles & tax guides

View all →Back taxes are taxes you owe for a previous year but haven't yet filed – and it's more common than most people realize. Financial hardship, a life change, or simply not knowing you had an obligation while living abroad can all lead to missed filings. Whatever got you here, the good news is that you have options, and acting sooner ra...

Most Americans who move abroad don't realize they're still required to file US tax returns – and by the time they do, they're often several years behind. Missing those filings can mean penalties, growing interest charges, and foreign account reporting violations that compound the longer they go unaddressed. Before divi...

Millions of people hold US citizenship without ever having lived or worked in the United States. The IRS, however, makes no distinction – under citizenship-based taxation, filing obligations follow you regardless of where you were born, where you live, or how long ago you last set foot on American soil. For accidental Americans who never kn...

For Americans living overseas, IRS Form 14653 is the required certification for the Streamlined Foreign Offshore Procedures that lets you catch up on missed filings without facing harsh penalties. The form includes a narrative state...

Many US taxpayers with foreign accounts or assets discover too late that the Internal Revenue Service expects full disclosure, even when the money, investments, or paperwork sits outside the US. Misunderstandings tend to cluster around “it’s overseas, so it doesn’t count” – and the IRS still holds the taxpayer (not t...

Delinquent FBAR Submission Procedures (DFSP) allow US taxpayers to file overdue foreign account reports without maximum penalties. If you missed FBAR deadlines for accounts exceeding $10,000 aggregate, DFSP provides a compliance path with typically $0 penalties if you have reasonable cause. This guide covers DFSP eligibility, acceptable...