Why work with Taxes for Expats

Deep expertise

Personalized service

Exceptional accuracy

Trusted by 50,000+ clients

Mentioned in

Discover 15+ key tax breaks for US expats

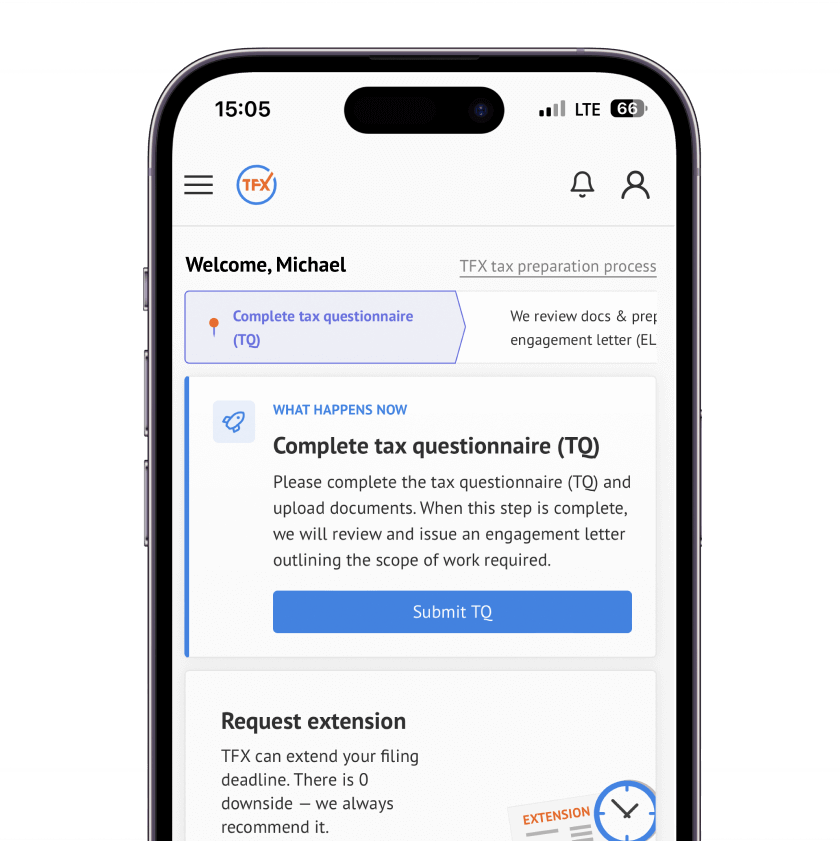

How we work

Expert, human accountant working on your case

Professionals who care & stand ready to answer your questions. Experienced humans who understand expat taxation in and out.

80+ accredited CPAs, EAs, JDs.

Real people, just like you.

50,000+ clients, 193+ countries, 4,000+ reviews

Frequently asked questions

At Taxes for Expats, we help individuals and businesses with US tax obligations, including:

- Americans living in the US or abroad

- Dual citizens with US passports

- Green card holders

- Accidental Americans

- Non-US citizens with US tax requirements

- Digital nomads

- US retirees living overseas

- Businesses with US tax requirements

No matter your situation, our team has the expertise to guide you through your US tax filing with confidence.

We offer Federal Income Tax Return and Expanded Income Bundles tailored to your specific tax filing needs. For a detailed overview of our fees, please visit: Our Fees.

To find out which documents and information are required for your tax preparation, please check our guide here: Tax Documents Needed.

Yes, we stand behind the work we do. If the IRS questions a return prepared by us, we will review the letter and advise you on the necessary steps. For more information, see: Received IRS Letter.

We offer free support via phone, email, and chat. For more information on our support options, please visit: Support Options Overview.

Absolutely. TFX has been preparing US expat taxes for over 25 years and is well-versed in the tax laws applicable to US expats worldwide.

Absolutely! If you’re a non-US citizen with US tax obligations – whether due to income earned in the US, business dealings, or other connections – we can help. Our team understands the complexities involved and will guide you through the necessary filings with ease.

We prepare a wide range of forms, including 1040/1040NR, Form 5471, Form 5472 with Form 1120, and many more. For a full list of forms we handle, please visit: Forms We Prepare.

Yes, we can file an extension for you at no additional cost. However, we require a $50 retainer, which will remain as a credit on your account for future TFX services.

We only work with seasoned CPAs or EAs who each have at least a decade of experience in the field. We don’t employ junior staff.

Our goal is to complete each tax return within fifteen (15) business days per filing year. We prioritize quality and accuracy, with every return undergoing a thorough review by both a preparer and a supervising CPA or EA.

If you're unsure whether you need to file US taxes, we can help you determine your filing requirements. Even if you're living abroad or have limited US ties, you may still have an obligation to file. We’ll review your specific situation and provide personalized guidance.

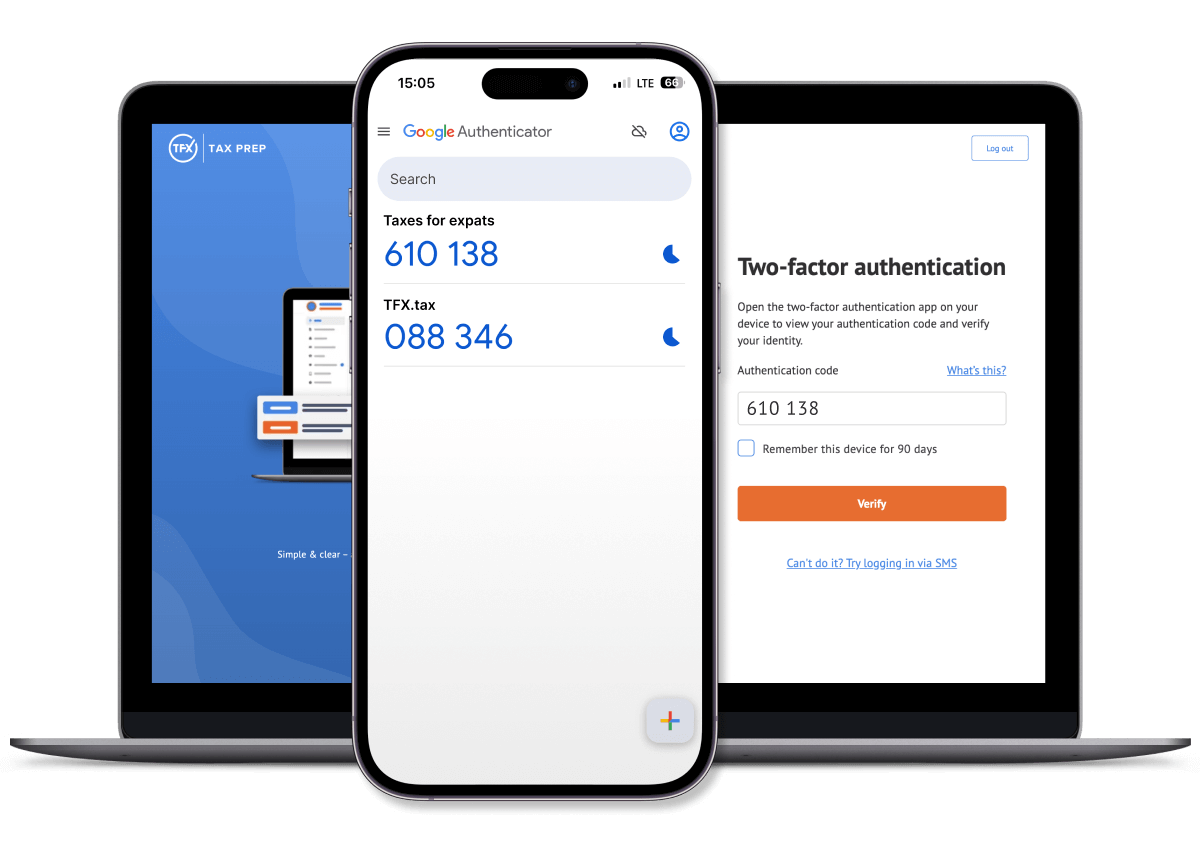

Top-tier security protocols to protect your information

All sensitive data is encrypted at rest and in transit using cutting-edge encryption protocols (AES-256). For added protection, we implement two-factor authentication (2FA), delivering an extra layer of security to safeguard your information against unauthorized access.

Articles & tax guides

View all →Delinquent FBAR Submission Procedures (DFSP) allow US taxpayers to file overdue foreign account reports without maximum penalties. If you missed FBAR deadlines for accounts exceeding $10,000 aggregate, DFSP provides a compliance path with typically $0 penalties if you have reasonable cause. This guide covers DFSP eligibility, acceptable...

If you’re a US citizen or resident who owns, benefits from, or contributes to a foreign trust – such as a foreign pension plan, or a family estate trust set up abroad – you’re likely dealing with a complex set of reporting obligations. Whether you’re planning to set up a trust or already receiving distribu...

The US remittance tax is a 1% federal excise tax on certain money transfers sent from the United States to foreign countries, effective January 1, 2026. The tax applies only to cash-funded transfers, including cash, money orders, and cashier's checks. Bank account transfers and US debit/credit card payments are exempt under IRC Section 4475.<...

The penalty for failing to report your foreign bank accounts in 2026 could cost more than the accounts themselves. Willful FBAR violation penalties reach up to the greater of $165,353 or 50% of the account balance. FinCEN's latest inflation adjustment and tighter enforcement, along with new court rulings, have made FBAR compliance r...

If you're earning income in the US but aren't a tax resident, you'll need to deal with Form 1040-NR. The form can feel like a maze of regulations and unfamiliar terms, but understanding it is necessary for staying compliant. This guide breaks down how Form 1040-NR works, so you can handle your tax obligations accurately and ...

Having covered the full mechanics of the Trump Account, its comparison with 529, what to do when your child turns 18, down to the exit strategies in case you are no longer interested, article 8 in our ...