US tax preparation for Americans in Ireland

Real people, just like you.

50,000+ clients, 193+ countries, 4,000+ reviews

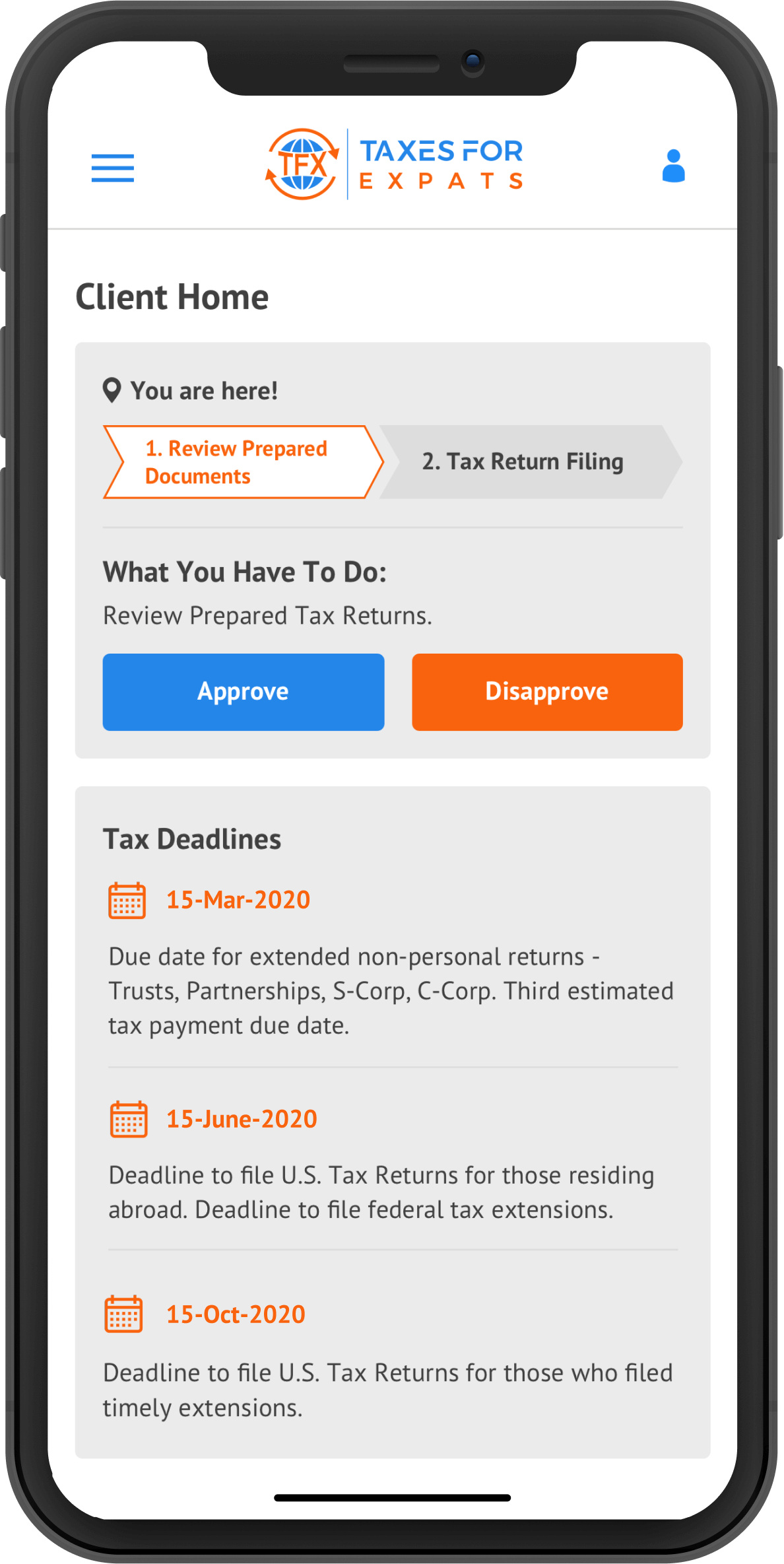

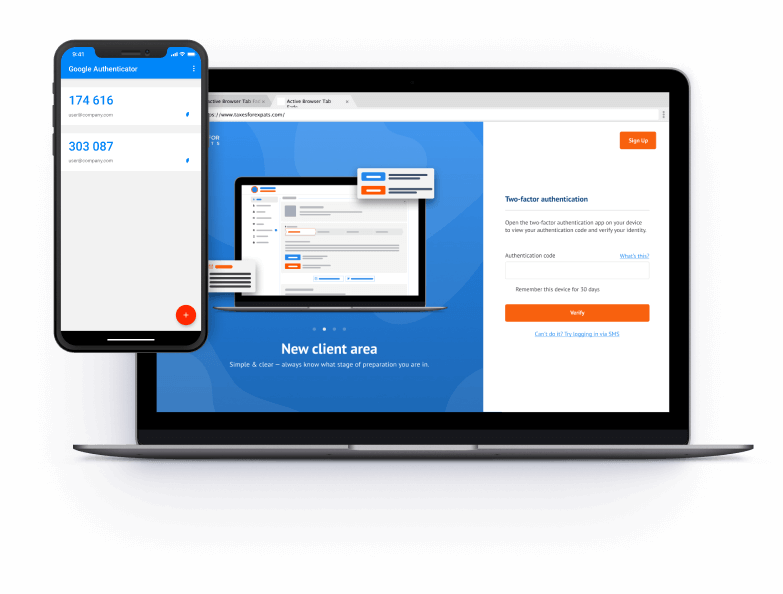

Data secured by

two-factor authentication

How TFX can help

Expert team, no junior staff

At TFX, we have been preparing business tax returns for over 25 years. We never hire junior staff. No outsourcing, no middlemen: you’ll be working directly with an experienced (our average age is 42) CPA or EA who will handle your case from beginning to end.

Help & support

Aside from knowledge, convenience and security are what we value at TFX. And these key features are what our clients are thrilled with. Our best-in-class secure online portal makes TFX the top-rated tax firm (with an average score of 4.8/5 on Trustpilot).

Phone consultations

In addition to tax filing & compliance, TFX offers tax planning & phone consultations. Choose a convenient time & book directly in your client portal.

Transparent pricing

TFX pricing is transparent, which means you’ll always know what you pay for.

We make it easy for you

-

Create

an account -

Complete

Tax questionnaire -

Sign

Engagement letter -

Sit back

while we work -

Pay

and review

Articles & tax guides

View all →Form 709, also known as the United States Gift and Generation-Skipping Transfer Tax Return, is a crucial document for those making significant gifts during their lifetime. The form is used to report taxable gifts, allocate the Generation-Skipping Transfer (GST) exemption, and ensure compliance with US gift tax regulations. Importantly, ...

A limited liability company – or LLC – is a flexible business structure that shields its owners (called “members”) from personal liability. It’s become especially popular with foreign entrepreneurs, as US LLC non-residents can form one without needing a green card or even setting foot in the States. ...

The IRS voluntary disclosure program closed on September 28, 2018. The IRS announced on March 13, 2018, that it would ramp down the 2014 Offshore Voluntary Disclosure Program (OVDP). OVDP closed on that date, and since then, the IRS has kept streamlined procedures for non-willful filings and the Criminal Investigation Voluntary Disclosu...

Many US citizens and green card holders discover far too late that past tax returns and foreign account reports were never filed. The stress builds fast, but this kind of non-compliance is more common than most people realize – and it usually stems from confusion, not intent. You're probably here because you've realized yo...

In 2014, the IRS changed the course of offshore compliance by launching the Streamlined Domestic Offshore Procedures – a relief path for US residents who had unknowingly failed to report foreign income and accounts. It offered a lifeline to those who made honest errors rather than deliberate omissions, replacing fear of massive penalties wi...

Many Americans living abroad discover that several foreign bank accounts should have been reported on FinCEN Form 114, with FBARs for the 2025 calendar year due April 15, 2026, and automatically extended to October 15, 2026, and decide to quietly file the missing forms without using an IRS compliance program – a step commonly referred to as...