US tax preparation for Americans in Austria

Real people, just like you.

50,000+ clients, 193+ countries, 4,000+ reviews

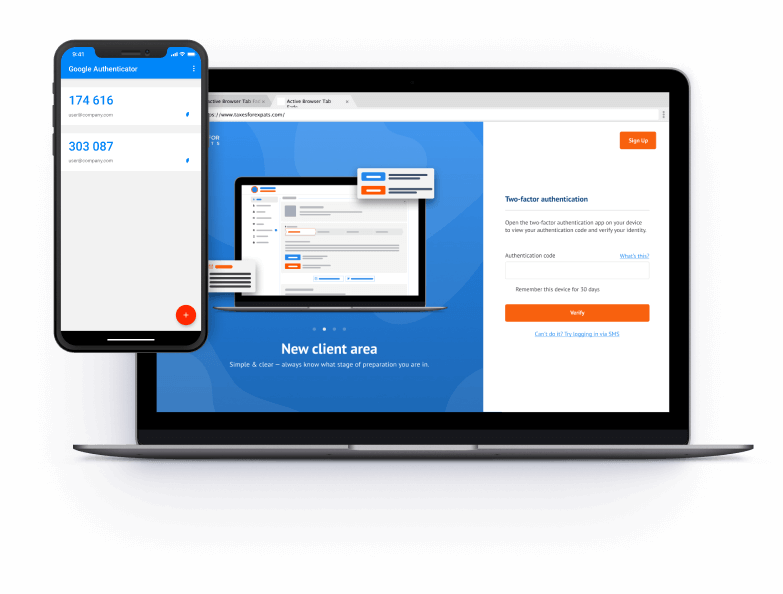

Data secured by

two-factor authentication

How TFX can help

Expert team, no junior staff

At TFX, we have been preparing business tax returns for over 25 years. We never hire junior staff. No outsourcing, no middlemen: you’ll be working directly with an experienced (our average age is 42) CPA or EA who will handle your case from beginning to end.

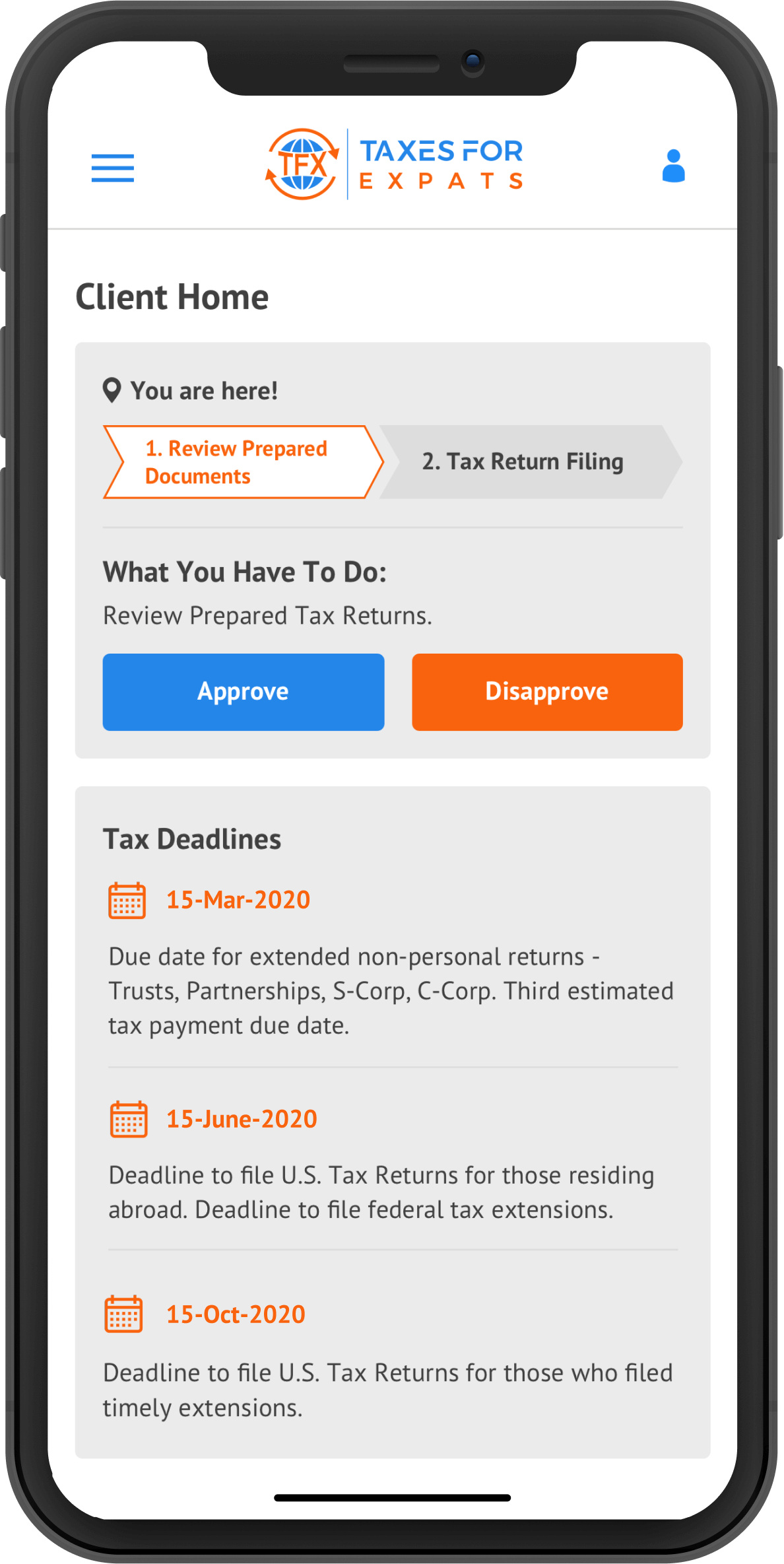

Help & support

Aside from knowledge, convenience and security are what we value at TFX. And these key features are what our clients are thrilled with. Our best-in-class secure online portal makes TFX the top-rated tax firm (with an average score of 4.8/5 on Trustpilot).

Phone consultations

In addition to tax filing & compliance, TFX offers tax planning & phone consultations. Choose a convenient time & book directly in your client portal.

Transparent pricing

TFX pricing is transparent, which means you’ll always know what you pay for.

We make it easy for you

-

Create

an account -

Complete

Tax questionnaire -

Sign

Engagement letter -

Sit back

while we work -

Pay

and review

Articles & tax guides

View all →For US expatriates, navigating the tax waters can be even more daunting than for stateside citizens. Understanding the common IRS audit triggers is essential in steering clear of tax woes. We have carefully compiled a list of 12 red flags that could prompt the IRS to take a closer look at your tax return. ...

US tax rules follow you no matter where you live. When you sell a home or land in another country, the IRS still wants you to report the profit. In simple words, you figure out how much money you made, convert the numbers into US dollars, and then apply the tax breaks that fit. If you sold in 2025 vs 2026: The year you ...

Delinquent FBAR Submission Procedures (DFSP) allow US taxpayers to file overdue foreign account reports without maximum penalties. If you missed FBAR deadlines for accounts exceeding $10,000 aggregate, DFSP provides a compliance path with typically $0 penalties if you have reasonable cause. This guide covers DFSP eligibility, acceptable...

If you’re a US citizen or resident who owns, benefits from, or contributes to a foreign trust – such as a foreign pension plan, or a family estate trust set up abroad – you’re likely dealing with a complex set of reporting obligations. Whether you’re planning to set up a trust or already receiving distribu...

The US remittance tax is a 1% federal excise tax on certain money transfers sent from the United States to foreign countries, effective January 1, 2026. The tax applies only to cash-funded transfers, including cash, money orders, and cashier's checks. Bank account transfers and US debit/credit card payments are exempt under IRC Section 4475.<...

The penalty for failing to report your foreign bank accounts in 2026 could cost more than the accounts themselves. Willful FBAR violation penalties reach up to the greater of $165,353 or 50% of the account balance. FinCEN's latest inflation adjustment and tighter enforcement, along with new court rulings, have made FBAR compliance r...